Finaxchange

Location

USA

Platform

Web development

Industry

Finanace

Timeline

11 months

Services

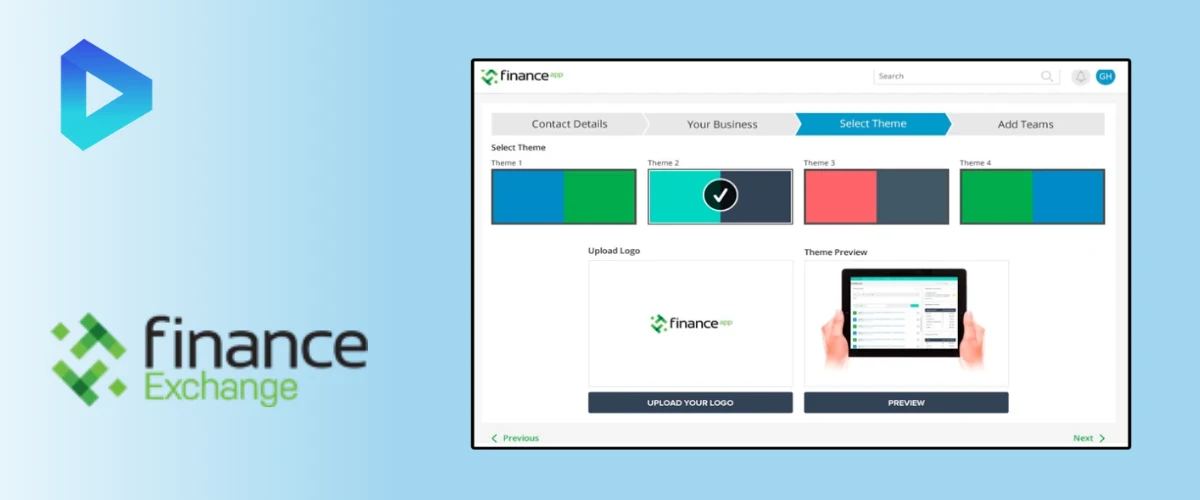

Custom Website Design & Development Financial Planner Website Design

Tech Stack

HTML5, CSS3, JavaScript, Bootstrap PHP, Node.js ,MySQL ,RSS/XML, Payment Gateways

PRODUCT OVERVIEW

FinanceExchange is a popular fintech marketplace based in Aliso Viejo, California, US that provides equipment lenders with a platform to manage originations, vendors, and syndication.

Finance Exchange is a tech-enabled company that provides equipment lenders with a platform to manage originations, vendors, and syndication.

THE CHALLENGE

THE CHALLENGE

The Founder of FinanceExchange was looking for an Equipment loan management software system platform because the existing process was outdated and ineffective. The outdated system had become a headache for lenders, vendors, and borrowers.

Most transactions require a significant amount of documentation, credit underwriting, and so forth between one or more parties. Spreadsheets, email, and limited Rolodex are the current way of conducting business. Seeing all these problems, the founder decided to create a loan management software system solution.

THE SOLUTION

After a quick turnaround, FinanceExchange was able to enter Loan Management System Solution for the first time without issue.

DigiPrima successfully implemented Equipment Loan Management Software/System Solution for FinanceExchange on time and within 6 months of contract. Solution which includes:

- Loan Management Software Solution

- Equipment Loan Management Software Solution

- Lenders Loan Management Software Solution

- Vendors Loan Management Software Solution

- loan borrowers Management Software Solution

In order to meet our client’s vision,our approach included:

- We built a team of engineers as an extension of our client’s research and in-house experts.

- We implemented a customized SCRUM framework for project management.

- We adopted a continuous integration and delivery model to meet their needs.

OUR TECHNICAL EXPERTISE

OUR TECHNICAL EXPERTISE

Our approach allowed us to provide our client with:

- An optimized, transparent and predictable development process with defined roles and iterations.

- A continuous delivery model and timely product deployment.

- Superior quality of code due to continuous integration practices that control defects during build and integration sprint cycles.

- A maintainable and scalable product thanks to a properly designed architecture and pro perly refactored code.

- Enhanced collaboration between product owners and development teams.

- A quality assurance competency lead who is responsible for setting up all test case tools.

DigiPrima’s AI development solutions empower financial systems to automate documentation and accelerate loan approvals with higher accuracy.

Key Features :

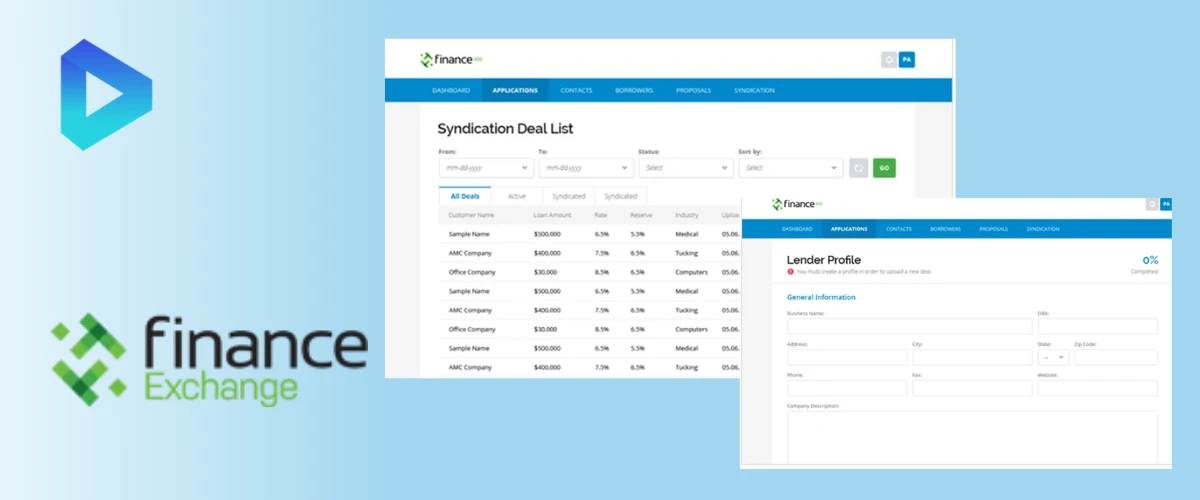

- Easily track deals in the pipeline rather than on spreadsheets and email.

- All communications are tracked with each deal and each lender.

- Centralized data storage

- Integrated credit assessment capabilities

- Automation of routine processes

- In-built analytic modules

- Third-party integration

- Security

Fill Your Requirements

Contact Info

Call Us 24/7 For Business Inquiry

[email protected]

[email protected]

+91 9039928143

Career Inquiry

[email protected]