Finance Exchange is a marketplace of Lenders, Borrowers and Equipment Vendors who can all transact more

efficiently in a safe and secure environment using modern cloud based software automation tools.

What all we did?

We can really relate to this project now that we’ve grown this product from where we approached it. So we

did all as below –

- Business analysis.

- Project Management.

- Designing and UX planning fully.

- Development of multiple POC (proof of concepts).

- Analyzing and integrating all the multiple POCs

- Quality Analysis done keeping in mind the standards of the finance industry.

- Product was made a white label and is SaaS.

- Now vision of this project is to make it easy and quick for manufacturers, dealers and small

businesses to acquire financing for their customer Problem Statements at low rates, fair terms and be

able to manage the process simply.

Problem Statement

Banks are looking for borrowers to use their money, borrowers looking at banks for loan and some

3rd party vendors looking to close the gap between borrowers and lenders. But all individually

which causes the classical Chinese whispers problem.

Our problem statement thus is bridging the gap between the loan providers, seekers and

facilitators via communication, calculator and management tools.

How did we approach it?

This platform was a tool that our client was looking for to bridge the gap between the loan

providers, seekers and facilitators a.k.a. vendors. It was not a domain we knew much about but

our skills to almost dig out solution from any problem thrown to us came into use.

Our client was really busy in seeking the right market for it and wanted to see us develop a

quick prototype that he could use. And that’s what was our first step - loan calculator.

A user could just come into the system, put their amount and tenure in and get the lowest EMI

possible for them with all details. That was the right start the client needed and then started

building a communications model around it. So now along with the calculation, the users could

speak to each other, share documents for verifications. Now was the last piece of the puzzle -

can we make them enter into a loan contract? And yes we did it in a way it was seamless!

Project Roadmap

- We started off by just supporting client by telling him we didn’t have this domain but had

the right intent and knowledge of our industry. All we needed was a little guidance in the

beginning. Chad was very supportive and made us learn his industry very nicely!

- Next was a POC (proof of concept), which was the tool of calculating the EMI.

- Then we thought along with the client - why not connect the users too - leading to another

PoC of communications model, which was iterative.

- Then was the POC of managing users. And its then we realized there were too many POCs, which

we needed to connect, and something we did in 2014 last 2 months.

- 2015 was a year we looked right into taking this product to the next level - allowing the

vendor type users OR the loan facilitators to seek more loan seekers. And we came up with a

proposals sending engine which utilized all contacts of the vendor while tracking each such

campaign taken. It was worth our time.

- We looked at controlling the white label and allowed the admin of SaaS users to make edits

to their “theme” and give it a shape. We improved on our analytics and super admin features

to have control of all users and accounts.

- At this stage we are refining the product to new business standards by working on things

like - auto loan suggest or tool, partner OR bank side of tasks where the banks can create

various types of loans and make them available.

- Vendors can now choose their loan program etc. too.

- Future work is all set as we take the drivers seat now.

Features and screenshots

- Loan engine. A loan seeker can just put the amount, use the slider and find out the lowest

EMI that can be applied for.

.png)

.png )

- SaaS based application. So we can set up multiple loan facilitators OR vendors as we term

them

.png)

.png)

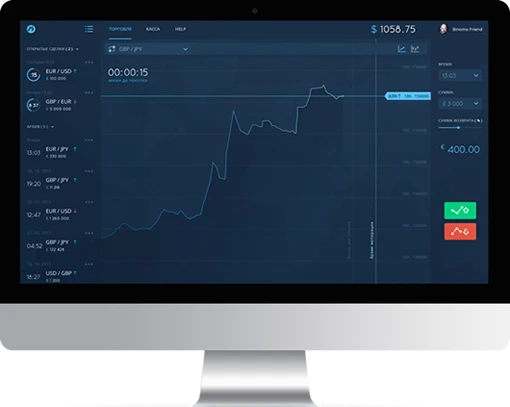

- Analytics for the Banking side. Where the bankers can look over the various numbers

.png)

- List of all applications that the borrower has created with status

.png)

- Proposals - the way the vendors can send proposals of banking to their contacts.

.png)

Current Situation

- There are about 9 white label instances created with customizations

- More than 250 lender/ vendors set up out of which the client has set up 3 of his own

companies.

- More than 3500 actual loan applications, created till now, and actual disbursement of

about $1,600,000.00.

- There are more than 2850 actual loan seekers (borrowers) registered in the system and

making applications for loans.

- Client is due to set up many partners into the system who can fuel the data overall.

- At a single time there are at least 45 people who are working on this product on daily

basis along with communication.

- There are 9 new instances have been

- There are tie-ups with big USA financial giants

- We are working on some future enhancements, which will change a lot of things on finance

side

.png)

.png )

.png)

.png)

.png)

.png)

.png)