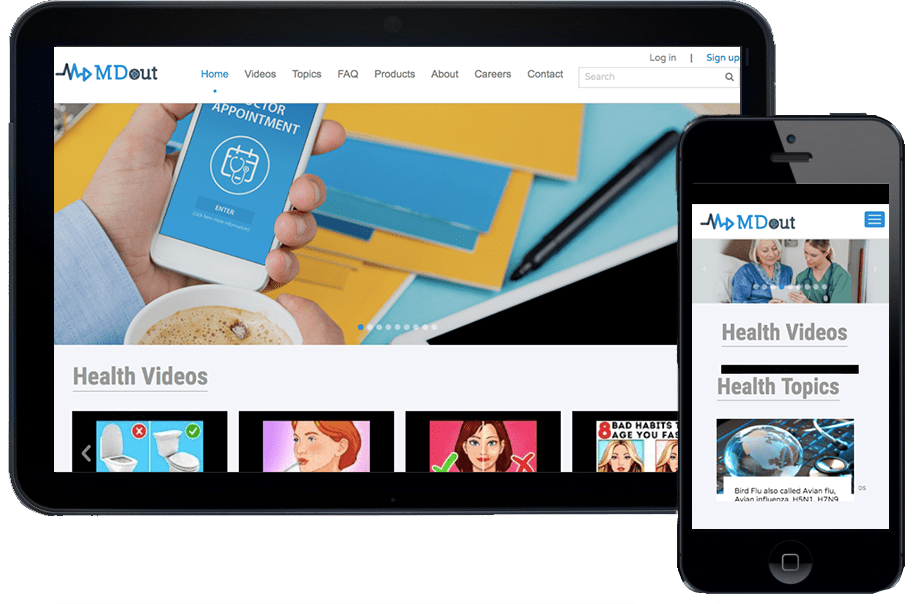

MDout, Inc. is a digital health platform based in

Livermore, California, USA, that focuses on empowering health organizations to be able to better

track, manage and improve health data.

Healthcare

MDout is a healthcare research and analytics company that leverages healthcare status,

survey, feedback and questionnaire systems to support provider decision making and patient

satisfaction in clinical settings. The MDout team of highly experienced healthcare

professionals combine deep domain expertise in healthcare, IT and statistics with a passion

for improving the patient and provider experience. MDout team and its products provide the

healthcare market with real-time data that improves the patient and provider experience for

better outcomes.

.webp)

The client hired DigiPrima to rewrite

the

software - he wanted a system used by healthcare centers for managing and reporting data on

medication inventory, clinical services, patient data, marketing activities, and more.

Within the project, the client also wanted the tool to allow its users to enable quality

population health analysis with instant reports. or Object Detection, Segmentation,

Keypoints or OCR.

Digiprima had taken the challenge to build a Single platform for Annotators, Annotation

Managers, and Data Scientists.

The objective of the client was included:

The DigiPrima team created the Healthcare Analytics System software for ID Care, which delivered actionable business insights by creating a business-aligned reporting and analytics strategy.

Real-Time Health Tracking : The solution enabled patients to use wearable medical

devices to measure their vitals and share it to their providers.

Pill Reminder : Missed doses or non-adherence to prescriptions is one of the biggest

reasons for deterioration of health, especially among patients who are senior citizens.

Nutrition Tracking : It is no surprise that our health largely depends on what we

eat. Knowing the nutritional benefits of daily diet is an excellent way to manage one's

health.

Chatbot : A chatbot goes a long way in improving the doctor-patient rapport and

fostering effective patient engagement. Patients may have doubts regarding their medication,

diet, or something recommended by their doctor.

Virtual Consultation : DigiPrima has developed a customized solution with a virtual

consultation facility to help patients receive care from anywhere.