With the sudden upwards trend of borrowers in India, our client wanted to refine and redefine the process of connecting individual borrowers with lending institutions by comparing loans and find the best option. In order to do so, our client first needed to select a partner with proven experience setting up and efficiently collaborating on multi-vertical projects.

We at Digiprima met this criterion. Thanks to our extensive experience and expertise in complex solutions for the financial and investment management domains.

Before we address how, lets first look at what exactly is Loan Moksha! LM is a simple yet advanced platform built to analyze the most common and basic problems faced by borrowers and develop the appropriate solution to resolve them with the help of advance processes and technology. In order to achieve its core goal, LM has tied-up with multiple lenders with different and unique lending criteria and preferences with an objective to support the end users in achieving their financial needs and goals.

This Free to use portal offers its users with multi layer data security and protection the best matched financial products based on their profile and needs which includes maximum loan amount at lowest possible interest rates along with minimum processing fees and sustainable tenure.

Armed with an idea, our client asked us to provide a solution with an intuitive and simple to user interface that would allow users to search, select and finalize their lending partners with ease.

In order to meet our client’s vision, our approach included.

Our approach allowed us to provide our client with:

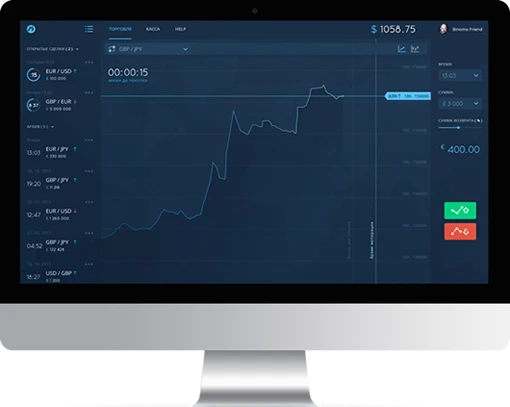

Build Strategic And Business Insights With Our Data Analysis Consulting Services

Digiprima corporate software development agency is available 24 hours a day, every day of the week, to collaborate and assist you in finding the best approach and technology that will assist you succeed with business intelligence, big data, and data science solutions.