Bluecode is the easiest way to

pay with your mobile phone and at the same time secure exclusive advantages. When you open the

app, a blue barcode is displayed, which is read at the checkout and enables payment. At the same

time, vouchers, collective passes and customer cards are automatically recognised.

Financial Services Industry

Custom applications using :

With each of your

purchases, a barcode valid for four minutes is created, which triggers a direct payment

process from your bank account. Simply download the app, connect your bank account and

you're ready to pay at more than 20,000 acceptance points and be rewarded for your loyalty

Mobile payments are up for

a challenging task. In order to

compete with traditional payment methods and the acceptance from customers and

merchants it needs to be everything that traditional methods are and more, and definitely

free from additional costs. Also merchants’ acceptance is required.

They of course want to reduce transaction costs both for themselves and

their customers and obviously it is the cheapest for everyone if the only payment method

were in cash. A lot of merchants do not own big businesses and can have financial

difficulties,

therefor they may not like the idea of paying for additional services. From the merchants

acceptance viewpoint it was the ease-of-use issue that also was relevant.

Since somecustomers sometimes want to use mobile payment, merchants got confused how to do

with

it. Even if they had initial training provided by the payment system distributor, it was

easy to

forget since the payment method was not frequently used.

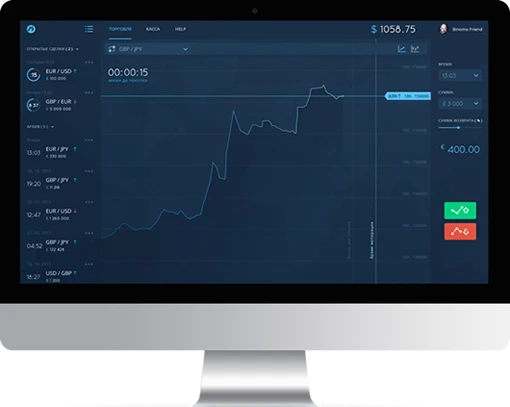

Contact us if you'd like to meet with one of our analytics experts about Fintech Tools

Management Software Solutions.We will be happy to consult with your team about your data and

discuss possible analysis strategies, expected results, and feasibility in your

organization.

Bluecode applies the so-called zero-knowledge principle. This ensures from the outset that your data cannot be misused and that your data will not be passed on in any other way (e.g. for advertising purposes). In addition, your bank details are encrypted on your smartphone and only reach our servers in our German data centers in encrypted form. Due to the AES algorithm used, such encryption is usually unbreakable.

Your Bluecode app is protected by Face ID, fingerprint (Touch ID) or security PIN and can only be used by you in connection with your mobile device.

Thefts happen every day.

But even in such cases, your data is secured by our security

features and blocking options. Our blocking hotline is available to you around the clock.